Exploring the World of Cryptocurrency: A Comprehensive Guide

Introduction to Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, making it decentralized. The most iconic cryptocurrency, Bitcoin, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, the landscape of digital currencies has evolved dramatically, giving rise to thousands of alternatives known as altcoins, such as Ethereum, Ripple, and Litecoin.

This guide aims to dive deep into the multifaceted world of cryptocurrencies, covering their underlying technology, investment strategies, legal considerations, and future predictions. Whether you are a complete novice or a seasoned investor, understanding the essence of cryptocurrency can empower you to navigate this transformative financial ecosystem.

The Technology Behind Cryptocurrency: Blockchain

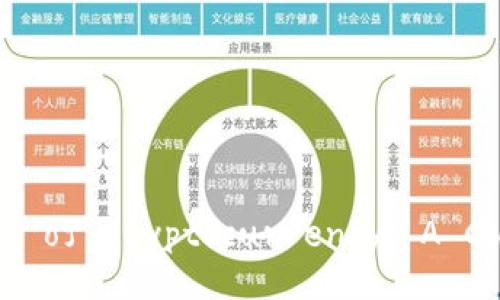

At the core of every cryptocurrency lies blockchain technology. A blockchain is essentially a distributed ledger that records all transactions across a network of computers. This technology is what enables cryptocurrencies to function without a central authority and ensures transparency, security, and immutability.

Each block in a blockchain contains a list of transactions, a timestamp, and a link to the previous block, creating a chain of blocks. This linking makes it nearly impossible to alter any information once it’s added to the blockchain, as it would require altering every subsequent block as well. The security of blockchains is reinforced by cryptographic techniques, making them highly resistant to fraud and cyber-attacks.

Blockchains can also be classified into various types: public, private, and consortium blockchains. Public blockchains allow anyone to participate, whereas private blockchains are restricted to certain users. Consortium blockchains add a layer of control, enabling specific organizations to create a semi-decentralized network. Understanding these types is crucial for organizations considering blockchain integration.

Investment Strategies in Cryptocurrency

Investing in cryptocurrencies can be rewarding, but it comes with significant risks due to high volatility. Here are some common strategies that investors use:

1. **HODLing:** This term originated from a misspelling of "hold" and refers to the strategy of buying and holding onto cryptocurrencies for the long term, regardless of market fluctuations.

2. **Day Trading:** This involves buying and selling cryptocurrencies on short-term price movements. Day traders often use technical analysis to make quick trading decisions.

3. **Dollar-Cost Averaging (DCA):** This strategy involves investing a fixed amount of money at regular intervals, regardless of the coin's price. This approach helps mitigate the risks of price volatility.

4. **Swing Trading:** Similar to day trading, swing trading entails holding onto a cryptocurrency for a few days or weeks to profit from expected upward or downward market swings.

5. **Diversification:** Just like in traditional investing, diversifying a cryptocurrency portfolio can reduce risk. This can be achieved by investing in various coins with different market capitalizations and technology bases.

Legal and Regulatory Considerations

The legal landscape surrounding cryptocurrencies is complex and constantly evolving. Regulations vary widely from country to country, affecting how cryptocurrencies can be used, traded, and taxed. Regulatory bodies globally are working to establish frameworks to protect consumers while allowing innovation to flourish.

In the United States, for instance, the Securities and Exchange Commission (SEC) has issued guidelines regarding the classification of cryptocurrencies as securities. This classification has implications for how Initial Coin Offerings (ICOs) need to operate, and non-compliance can lead to severe penalties.

In contrast, some countries have embraced cryptocurrency by establishing favorable regulatory environments. Malta, for example, has become a hub for blockchain and cryptocurrency businesses, offering legal certainty and fostering innovation.

Staying informed about the legal environment is critical for anyone involved in cryptocurrency, as regulations can affect not only investment strategies but also the viability of projects. Consulting with legal professionals familiar with cryptocurrency laws can help mitigate risks associated with compliance.

The Future of Cryptocurrency

The future of cryptocurrency may hold exciting developments. Many industry experts believe that cryptocurrencies and blockchain technology will continue to disrupt traditional financial systems. The rise of Decentralized Finance (DeFi) platforms shows that financial services can be offered without intermediaries, potentially leading to greater inclusivity and access.

Moreover, the integration of cryptocurrencies into the mainstream could accelerate with the advent of Central Bank Digital Currencies (CBDCs). Many nations are exploring digital currencies backed by central banks, which could coexist with existing cryptocurrencies.

However, challenges remain, particularly concerning scalability, environmental impact, and regulatory scrutiny. Ethereum, for example, is undergoing a transition to Ethereum 2.0 to improve scalability and reduce energy consumption, addressing some criticisms of blockchain technology.

The cryptocurrency marketplace is also becoming increasingly competitive. With new projects launching frequently, users must conduct extensive research to understand the fundamentals and potential of different cryptocurrencies.

Frequently Asked Questions

Q1: How is the value of cryptocurrencies determined?

The value of cryptocurrencies is influenced by several factors, including supply, demand, market sentiment, and overall utility. Unlike traditional currencies backed by physical assets or government policies, cryptocurrencies derive their value from user adoption and usage.

Supply and demand play a crucial role in price determination. For instance, Bitcoin has a capped supply of 21 million coins, and as demand grows, scarcity can drive prices higher. Additionally, significant events in the marketplace, such as regulatory changes or major technological advancements, can dramatically influence prices.

Market sentiment, driven by news, social media, or influential figures, can also sway investor sentiment and affect cryptocurrency prices. Understanding market psychology is essential for investors looking to navigate these markets successfully.

Q2: What are the major risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies involves several risks. The most notable include high price volatility, lack of regulation, security risks, and technological vulnerabilities.

Price volatility can result in massive gains or significant losses in a short time. As cryptocurrencies can drop or soar within minutes, potential investors should be prepared for these drastic price fluctuations.

The lack of regulation poses risks as well. Market manipulation, scams, and fraudulent projects can run rampant in an unregulated environment, leaving inexperienced investors vulnerable.

Security is another major concern, as cryptocurrency exchanges and wallets are targets for hackers. Keeping assets secure through cold storage and using reputable platforms is essential to mitigate these risks.

Q3: How can individuals safely store their cryptocurrencies?

Storing cryptocurrencies securely is vital to protect them from theft or loss. There are several storage methods, each with its pros and cons.

1. **Hot Wallets:** These are online wallets connected to the internet, allowing for quick access and convenience. While easy to use, they are more susceptible to hacking.

2. **Cold Wallets:** These wallets are offline, thus providing an additional layer of security. Hardware wallets and paper wallets fall into this category. They are not as convenient for frequent transactions but offer better security against online threats.

Choosing the right storage method depends on an individual's needs, with many users opting for a combination of both hot and cold wallets to balance accessibility and security.

Q4: How do I choose the right cryptocurrency to invest in?

Choosing the right cryptocurrency involves extensive research and consideration of various factors. Start by assessing the project's fundamentals, such as the technology behind it, the team involved, and the problem it aims to solve.

Market capitalization can also provide insight into the cryptocurrency's stability. Larger market caps generally indicate more established coins, but smaller projects may offer significant growth potential.

Review community engagement as well. Strong communities often indicate dedicated support, which can impact a cryptocurrency's longevity. Analyzing trading volumes and market trends is also vital to gauge investor interest.

Q5: What impact does cryptocurrency have on traditional financial systems?

Cryptocurrencies challenge traditional financial systems in several ways. Their decentralized nature reduces the reliance on banks and financial institutions, potentially leading to greater inclusivity.

Additionally, the rise of DeFi platforms offers financial services like lending and trading without intermediaries, attracting users from traditional banking systems.

However, challenges remain, such as regulatory hurdles and concerns about financial security. As cryptocurrencies become more integrated into everyday transactions, financial systems may need to evolve to accommodate and regulate these new forms of currency.

In conclusion, the world of cryptocurrency is vast and multifaceted, filled with opportunities and challenges alike. Understanding the technological foundations, investment strategies, and potential legal implications can empower individuals to navigate this dynamic landscape effectively.