Title: Navigating the Waves of Cryptocurrency Markets: A Com

Cryptocurrency has become a household term in today's digital economy, capturing the attention of investors, tech enthusiasts, and everyday users alike. As the sun rises over the financial landscape, painting it with shades of hope and innovation, the question arises: how can one navigate the often tumultuous waters of cryptocurrency markets? This analysis dives deep into the currents shaping these digital assets, providing insights that could empower you to ride the waves of opportunity.

Understanding the Cryptocurrency Landscape

Imagine standing on a bustling street in Tokyo, vibrant neon lights flickering as people hurriedly pass by, each absorbed in their world. This energy mirrors the cryptocurrency market—a dynamic, ever-evolving environment filled with potential and uncertainty. The digital currency ecosystem is not just about Bitcoin and Ethereum anymore; it encompasses thousands of altcoins, each with its unique story and purpose, akin to the diverse cultures found in a global metropolis.

In this intricate tapestry, one must consider several factors that contribute to the rise and fall of cryptocurrency prices. Market sentiment, technological advancements, regulatory news, and macroeconomic indicators are just a few threads woven into this fabric. Furthermore, the emotional investment of the community, much like the passion of fans cheering for their favorite sports team, significantly influences market dynamics.

Market Sentiment: The Pulse of Investors

Picture a sea of traders; their faces illuminated by the glow of computer screens, eyes wide with anticipation as they monitor price movements. Market sentiment acts like the weather in this analogy—sometimes sunny, often stormy. Investors' feelings and perceptions can create waves of volatility, swaying prices without warning.

For instance, consider the recent surge in the price of Dogecoin. Following a series of tweets from influential figures, the digital currency skyrocketed, reflecting the power of social media in shaping investor sentiment. Such phenomena can create an atmosphere filled with excitement or despair, influencing investment decisions significantly. Tools like sentiment analysis—akin to weather forecasting—can help investors gauge market moods, guiding their strategies through fluctuations.

The Role of Technology and Innovation

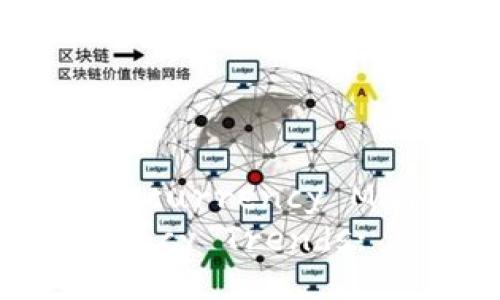

As the gears of technology continue to turn, they create a backdrop for the renaissance of digital currency. Blockchain technology, the foundation of cryptocurrencies, is akin to the invention of the printing press, revolutionizing the way we think about transactions and trust. Projects focused on scalability, privacy, and interoperability push the envelope, just as groundbreaking inventions changed society throughout history.

Consider Ethereum's smart contracts, enabling automatic execution of agreements, streamlining operations, and reducing the reliance on intermediaries. This innovation, paired with the rise of decentralized finance (DeFi), transforms traditional financial practices, offering new possibilities for users worldwide. Investors must stay alert to such technological advancements, as they often precede substantial price movements in associated cryptocurrencies.

Regulatory Influences: Navigating the Legal Seas

Regulatory news can drastically alter the course of cryptocurrency markets, akin to sudden storms that disrupt a calm sea. Governments around the world are grappling with how to approach this innovative space, resulting in a patchwork of regulations that often vary from one country to another. In 2021, China's crackdown on cryptocurrency mining sent shockwaves through the market, causing prices to plummet. On the other hand, positive regulatory frameworks, as seen in countries embracing blockchain technology, can catalyze growth.

Staying informed about regulatory developments is crucial for investors. Engaging with reliable news sources and understanding the implications of policy changes can provide a competitive edge, helping navigate through uncertain waters. Building a portfolio resilient to regulatory shifts can be likened to constructing a ship sturdy enough to weather any storm.

Macroeconomic Indicators: The Broader Context

Imagine sitting in a cozy café, sipping coffee while watching the world go by outside. The economic environment dramatically influences cryptocurrency prices, much like the changing seasons affect the behavior of nature. Inflation rates, interest rates, and overall economic health can harness the power to shape market dynamics.

For instance, during times of economic uncertainty, investors may flock to cryptocurrencies as a hedge against inflation, similar to how travelers seek shelter during a storm. Understanding these macroeconomic indicators is crucial for making informed investment decisions, allowing one to spot trends and anticipate market movements effectively.

Developing Your Cryptocurrency Investment Strategy

With a better grasp of the myriad factors affecting cryptocurrency markets, it's time to craft your investment strategy. Picture a skilled sailor charting a course through open waters; strategic planning is key to navigating the unpredictable sea of cryptocurrencies. Here are some essential elements to consider:

- Diversification: Just as a well-balanced diet is essential for physical health, diversifying your cryptocurrency portfolio can protect against the potential fallout of individual asset volatility. Consider allocating investments across multiple coins, balancing risk and reward.

- Research and Analysis: Equip yourself with knowledge, seeking out the latest news, reports, and analyses. Embrace tools like technical analysis and fundamental analysis, akin to using navigation instruments on your voyage.

- Emotional Discipline: While market fluctuations can provoke emotional responses, maintaining discipline is crucial. Like experienced sailors, successful investors learn to trust their strategies and avoid impulsive decisions based on temporary market sentiment.

- Long-term Perspective: The cryptocurrency market can resemble a rollercoaster, offering exhilarating highs and nerve-wracking lows. Adopting a long-term perspective can help you stay grounded amidst the chaos, focusing on the broader horizon rather than short-term price movements.

Conclusion: Your Journey Awaits

As you set sail into the realm of cryptocurrency, armed with knowledge and strategy, remember that the digital sea is vast and filled with opportunities. The tales of triumph and adversity echo throughout the landscape, reminding us that success often stems from perseverance and informed decision-making. As the sails fill with wind and the compass points toward your goals, embrace the adventure with an open heart and a curious mind.

The world of cryptocurrency waits for you, full of promise and potential. Join the ranks of passionate investors and innovators, and may your journey through these digital waters be both enlightening and rewarding. Happy investing!